Research to Books

From hot topics to state taxes, find the research resources you need to stay complaint for your clients.

U.S. Master Tax Guide® (2025)

Published: November 2024

The U.S. Master Tax Guide provides helpful and practical guidance on today's federal tax law. This 106th Edition reflects all pertinent federal taxation changes that affect 2023 returns and provides fast and reliable answers to tax questions affecting individuals and business income tax.

$217

Buy Now

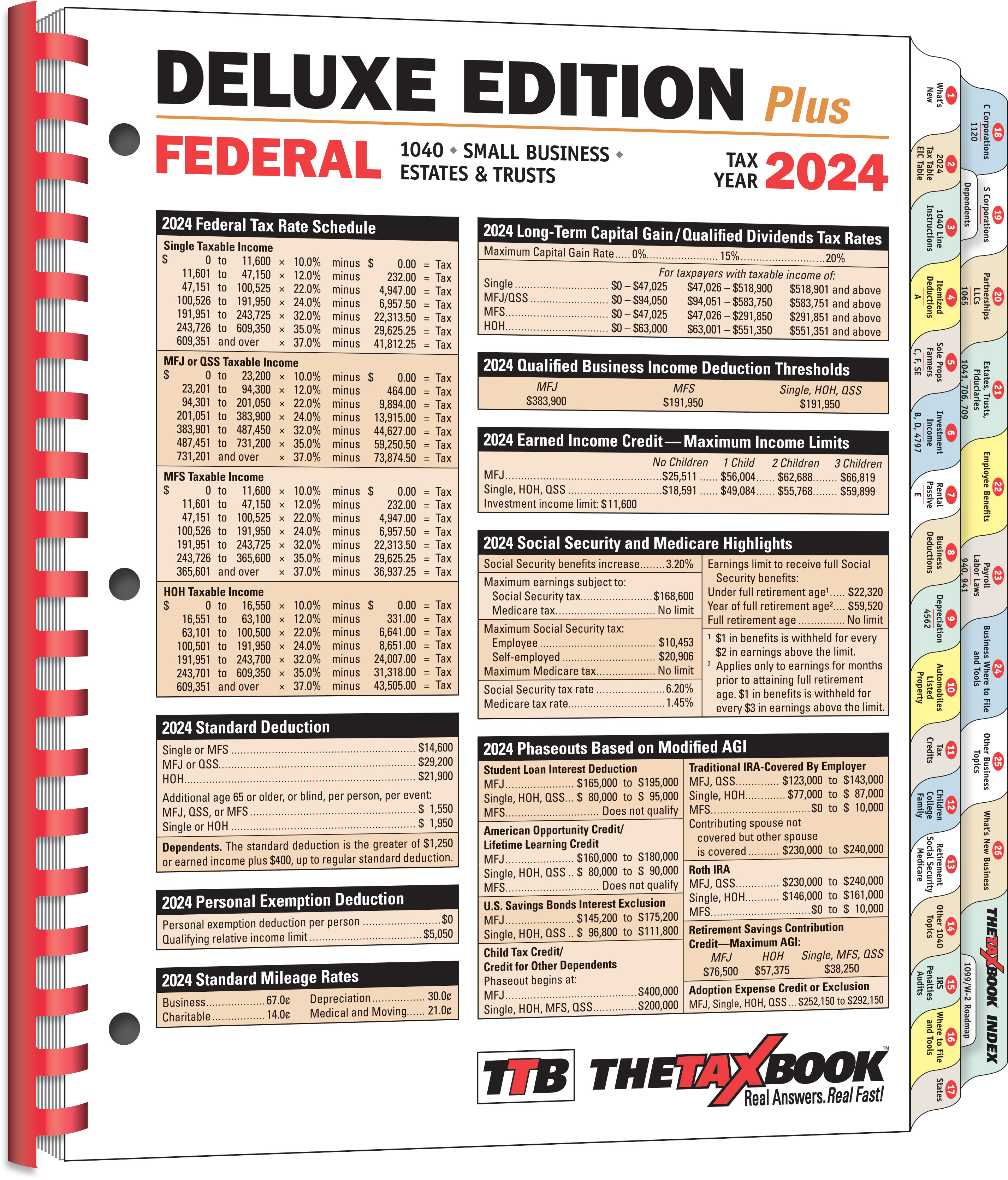

The TaxBook™ Deluxe Edition PLUS

Published: December 2024

Saving time, especially during tax season, is important! The TaxBook Deluxe provides a concise, easy-to-understand topical summary of key tax laws and rules for tax preparation. Round-out your tax research library with these reference guides in a tabbed fast-answer format. Content includes the entire 1040 Edition plus C Corporations, S Corporations, Partnerships, Estates, Trusts, and more.

$99

Buy Now

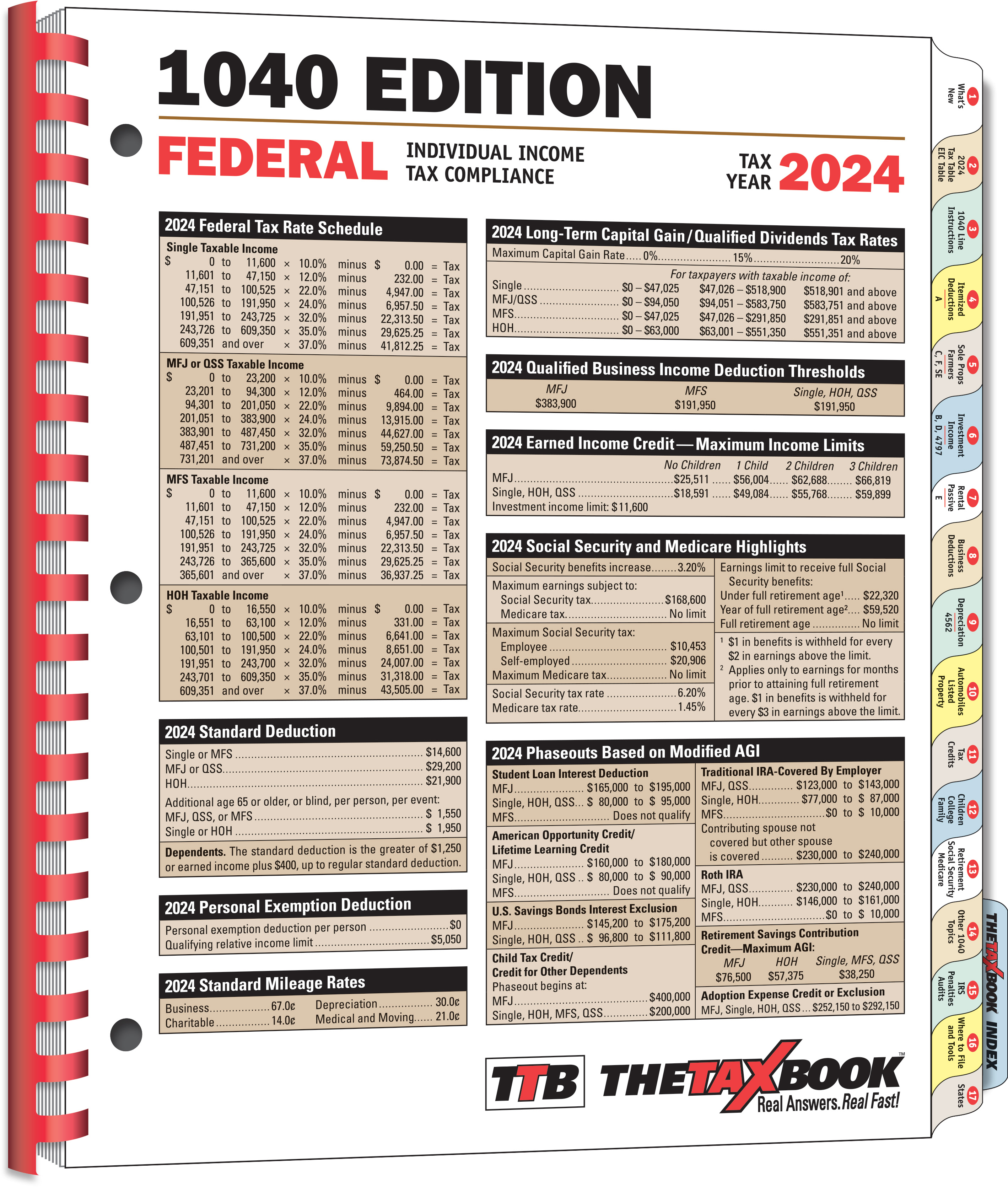

The TaxBook™ 1040

Published: December 2024

Saving time, especially during tax season, is important! The TaxBook 1040 provides a concise, easy-to-understand topical summary of key tax laws and rules for tax preparation. Round-out your tax research library with these reference guides in a tabbed fast-answer format. Fast answers to your income tax questions! Find information on common and not-so-common IRS forms and schedules.

$75

Buy Now

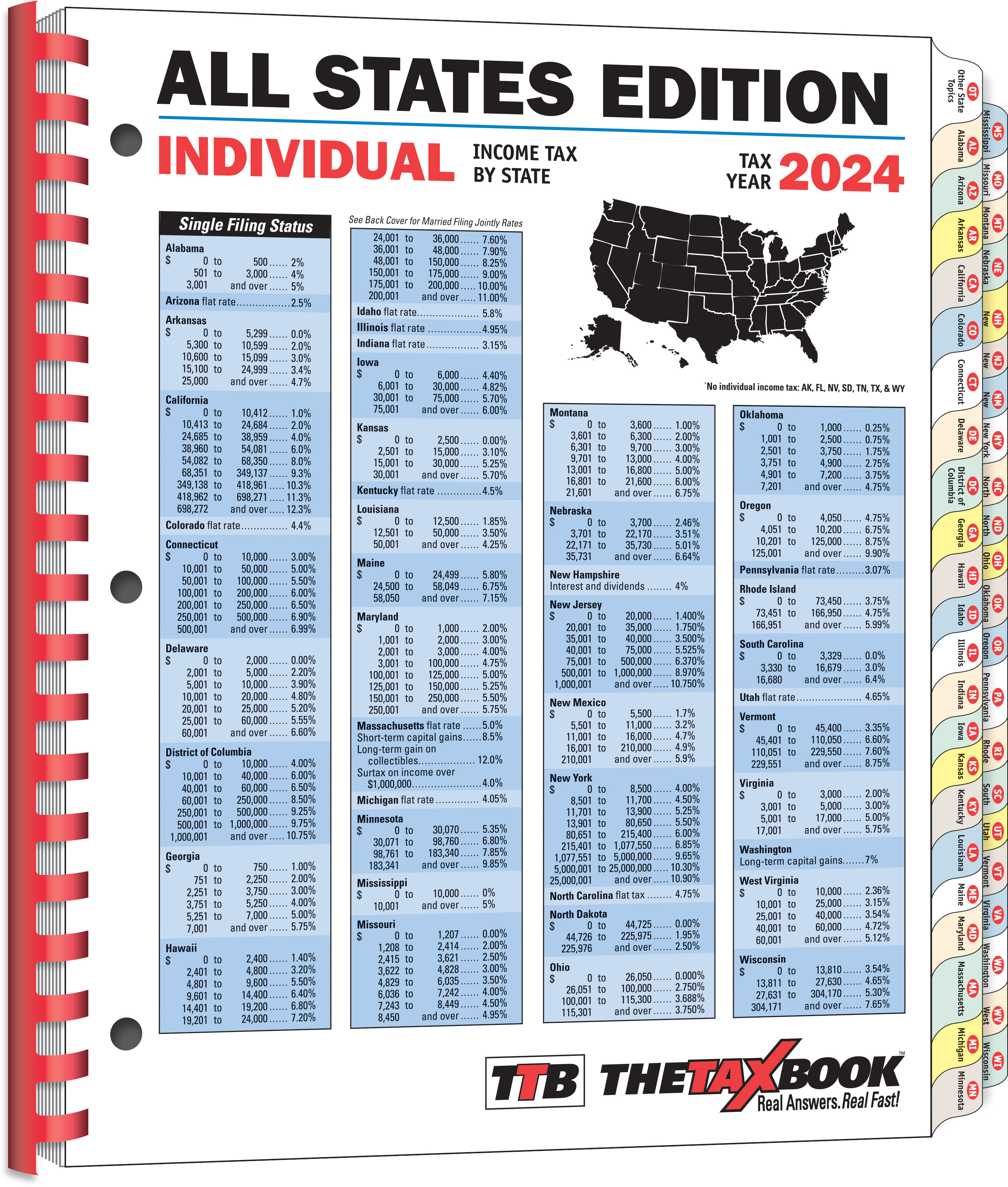

The TaxBook™ All States

Published: February 2025

The TaxBook All States edition is the perfect book for tax preparers that prepare out-of-state returns. This book contains fast answers to state specific individual tax questions. Content includes individual tax rates, filing requirements, additions, subtractions, adjustments, exemptions, credits, and more for each state.

$102

Buy Now

GAAP Guide® (2024)

Published: November 2024

CCH's GAAP Guide provides the most comprehensive resource for understanding and applying authoritative GAAP literature in clear language. Each FASB Accounting Standards Codification pronouncement/topic is discussed in a comprehensive format that makes it easy to understand and implement in day-to-day practice. Practical illustrations and examples demonstrate and clarify specific accounting principles.

$737

Buy Now

State Tax Handbook

Published: December 2024

The perfect quick-answer tool for tax practitioners and business professionals who work with multiple state tax jurisdictions. Save time by utilizing a single source of key state tax information instead of having to consult multiple sources. The Handbook is set out in four parts, which together deliver an overall picture of the states' levies, bases and rates of each tax, principal payment and return dates, and other important information on major state taxes.

$266

Buy Now

New Jersey Taxes, Guidebook to

Published: December 2024

The perfect resource for concise explanation for practitioners working with state taxation in New Jersey, presenting succinct discussions of state and local taxes.

$266

Buy Now

California Taxes, Guidebook to

Published: December 2024

Widely used by practitioners and all those involved in California taxes, this time-saving guide is accepted as the premier source for quick reference to all taxes levied by the state.

$266

Buy Now

New York Taxes, Guidebook to

Published: December 2024

This is the perfect resource for concise explanation for practitioners working with state taxation in New York.

$266

Buy Now

U.S. Master Depreciation Guide (2025)

Published: December 2024

The U.S. Master Depreciation Guide offers tax and accounting professionals who work with businesses a one-stop resource for guidance in understanding and applying the complex depreciation rules to their fixed assets.

$374

Buy Now

Florida Taxes, Guidebook to

Published: November 2024

The perfect resource for concise explanation for practitioners working with state taxation in Florida, presenting succinct discussions of state and local taxes.